Delving into car insurance lawsuit, this introduction immerses readers in a unique and compelling narrative. Exploring the various aspects of car insurance lawsuits, from common reasons to legal procedures, this topic sheds light on the complexities and challenges faced by individuals and insurance companies alike.

Overview of Car Insurance Lawsuits

Car insurance lawsuits are legal actions taken by individuals or entities against insurance companies or other parties involved in a car insurance claim. These lawsuits typically arise when there is a dispute over coverage, liability, or the amount of compensation offered.

Common reasons that lead to car insurance lawsuits include denial of claims, disputes over fault in an accident, disagreements on the extent of coverage provided by the policy, delays in claim processing, or bad faith practices by the insurance company.

The implications of a car insurance lawsuit can be significant for both individuals and insurance companies. For policyholders, a lawsuit can result in a prolonged legal process, financial strain, and uncertainty regarding the outcome of the claim. On the other hand, insurance companies may face reputational damage, financial losses from settlements or court judgments, and increased scrutiny from regulatory bodies.

Types of Car Insurance Lawsuits

Car insurance lawsuits can take various forms, each with its own unique characteristics and legal processes. Understanding the different types of car insurance lawsuits is crucial for both policyholders and insurance companies.

Liability Claims

Liability claims are one of the most common types of car insurance lawsuits. These lawsuits typically arise when a driver is found to be at fault for causing an accident that results in injuries or property damage to another party. The injured party may file a claim against the at-fault driver’s insurance to seek compensation for their losses.

Bad Faith Claims, Car insurance lawsuit

Bad faith claims occur when an insurance company acts in a deceptive or unfair manner towards its policyholders. This can involve denying valid claims, delaying the claims process, or offering unreasonably low settlements. Policyholders can file a bad faith lawsuit against their insurance company to seek compensation for damages caused by the insurer’s wrongful actions.

Comparison of Processes

- Liability claims typically involve proving fault and determining the extent of damages caused by the at-fault driver.

- Bad faith claims focus on proving that the insurance company acted unreasonably or dishonestly in handling the policyholder’s claim.

- The legal process for liability claims may involve negotiations, mediation, or court proceedings to determine liability and compensation.

- Bad faith claims often require demonstrating that the insurer breached its duty of good faith and fair dealing towards the policyholder.

High-Profile Car Insurance Lawsuit Cases

One notable high-profile car insurance lawsuit case is the Erin Andrews case against Marriott International. Andrews sued Marriott for negligence after a stalker filmed her through a peephole in her hotel room. The lawsuit included claims against Marriott’s insurance company for failing to protect her privacy and safety.

Legal Procedures in Car Insurance Lawsuits

When it comes to car insurance lawsuits, there are specific legal procedures that must be followed to ensure a fair and just resolution for all parties involved. From filing the initial claim to presenting evidence in court, each step plays a crucial role in the outcome of the case.

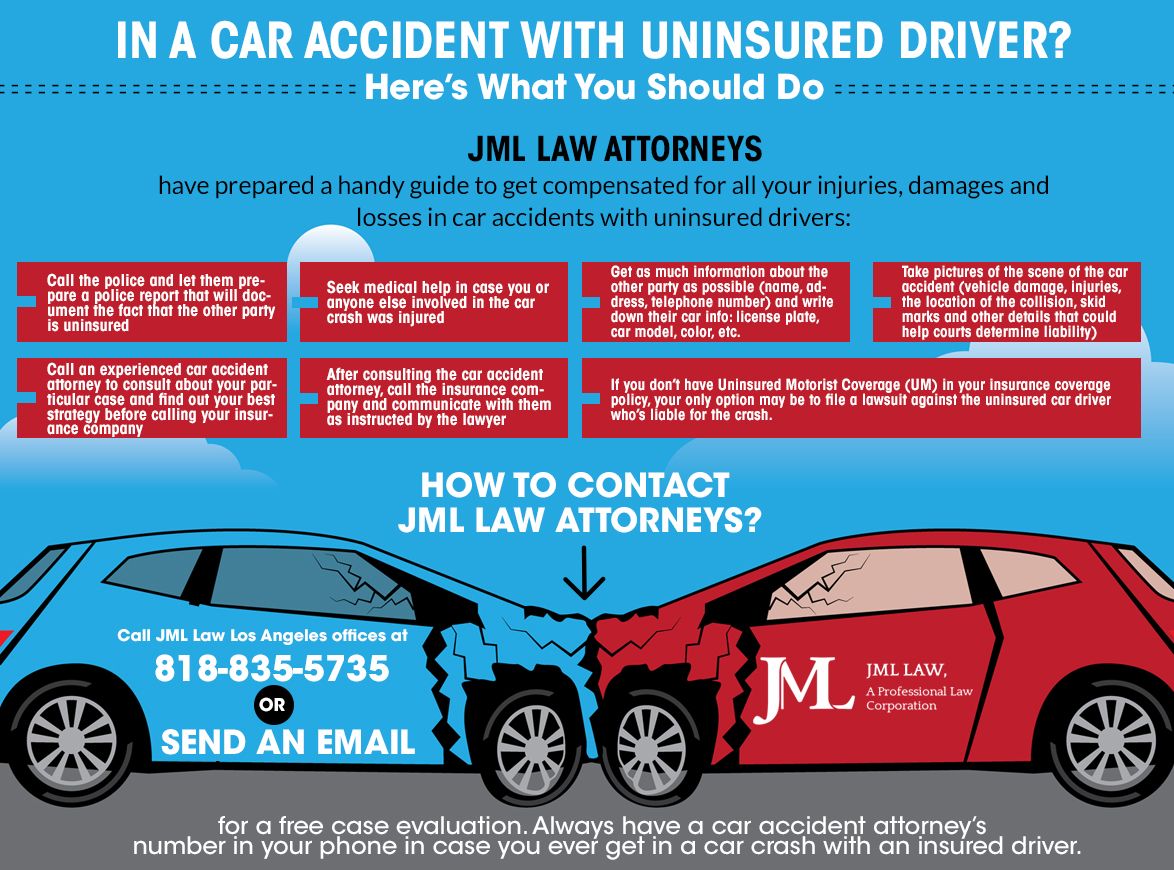

Filing a Car Insurance Lawsuit

In order to file a car insurance lawsuit, the plaintiff must first notify the insurance company of their intent to file a claim. This usually involves submitting a written notice detailing the nature of the claim, the damages suffered, and any other relevant information. Once the claim is submitted, the insurance company will conduct an investigation to determine liability and assess the extent of the damages.

Role of Attorneys in Car Insurance Lawsuits

Attorneys play a critical role in representing clients in car insurance lawsuits. They provide legal guidance, prepare legal documents, negotiate settlements, and represent their clients in court. Attorneys work diligently to protect the rights of their clients and ensure they receive fair compensation for their losses.

Gathering and Presenting Evidence

In car insurance lawsuits, evidence plays a key role in proving liability and determining the extent of damages. Attorneys work with their clients to gather relevant evidence such as police reports, medical records, witness statements, and expert testimony. This evidence is then presented in court to support the client’s case and help secure a favorable outcome.

Settlements and Verdicts in Car Insurance Lawsuits

When it comes to car insurance lawsuits, reaching a settlement or obtaining a verdict can significantly impact the outcome of the case. Let’s delve into the details of how settlements and verdicts are determined in car insurance lawsuits and the factors that influence these decisions.

Settlement Process in Car Insurance Lawsuits

Settlements in car insurance lawsuits typically involve negotiations between the parties involved, including the insurance company, the plaintiff, and their legal representatives. During these negotiations, both parties strive to reach an agreement on a fair and acceptable amount to resolve the case outside of court.

- Parties may consider factors such as the extent of the damages, liability, and the strength of the evidence presented.

- Settlements can help avoid the time, costs, and uncertainties associated with a trial, providing a quicker resolution for all parties involved.

- Once an agreement is reached, the parties sign a settlement agreement, outlining the terms and conditions of the settlement.

Verdict Determination in Car Insurance Lawsuits

Verdicts in car insurance lawsuits are determined by a judge or jury after a trial where each party presents their case, evidence, and arguments. The verdict can result in a decision in favor of the plaintiff, the defendant, or a combination of both.

- The judge or jury considers the facts of the case, applicable laws, and legal precedents to reach a verdict.

- Verdicts can include awards for damages, such as compensation for medical expenses, lost wages, pain and suffering, and other losses incurred due to the accident.

- The verdict is typically final, unless appealed by one of the parties involved in the case.

Factors Influencing Settlement Amounts and Verdicts

Several factors can influence the amount of a settlement or the outcome of a verdict in car insurance lawsuits. These factors can vary depending on the specifics of each case and the parties involved.

- The severity of the injuries sustained in the accident and the resulting medical expenses can play a significant role in determining settlement amounts and verdicts.

- Evidence presented during the trial, including witness testimonies, expert opinions, and documentation, can impact the decision-making process.

- The insurance policy limits of the at-fault party’s coverage may also influence the settlement amount, as it dictates the maximum amount the insurance company is willing to pay.

Concluding Remarks

In conclusion, the world of car insurance lawsuits is intricate and multifaceted, with settlements and verdicts playing a crucial role in determining outcomes. By understanding the legal procedures and implications involved, individuals can navigate these situations with greater clarity and awareness.

FAQ Guide

What are some common reasons for car insurance lawsuits?

Common reasons include disputes over liability, denial of claims, and bad faith practices by insurance companies.

How are settlements reached in car insurance lawsuits?

Settlements are typically negotiated between the parties involved, often with the assistance of attorneys, to resolve the case outside of court.

What role do attorneys play in car insurance lawsuits?

Attorneys represent clients in car insurance lawsuits by providing legal advice, negotiating settlements, and presenting cases in court if necessary.

What factors influence the amount of settlements and verdicts in car insurance lawsuits?

Factors such as the extent of damages, insurance policy coverage, and evidence presented can influence the final settlement amount or verdict in a car insurance lawsuit.