How much is auto insurance in Massachusetts? This guide explores the various factors influencing insurance rates, the minimum requirements, average costs, and tips for saving money.

Delve into the details of auto insurance in Massachusetts to make informed decisions and potentially lower your insurance expenses.

Factors Affecting Auto Insurance Rates in Massachusetts

Auto insurance rates in Massachusetts are influenced by several key factors that insurers take into consideration when determining premiums. These factors can vary from one individual to another, leading to differences in insurance costs.

Age

Age plays a significant role in determining auto insurance rates in Massachusetts. Generally, younger drivers under the age of 25 tend to pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers above the age of 65 may also face higher rates due to factors such as diminished reflexes and potential health issues.

Driving Record

Another crucial factor that impacts auto insurance rates in Massachusetts is the driver’s history of accidents and traffic violations. A clean driving record with no previous accidents or tickets can lead to lower premiums, as it demonstrates responsible driving behavior. Conversely, a history of accidents or speeding tickets can result in increased insurance costs.

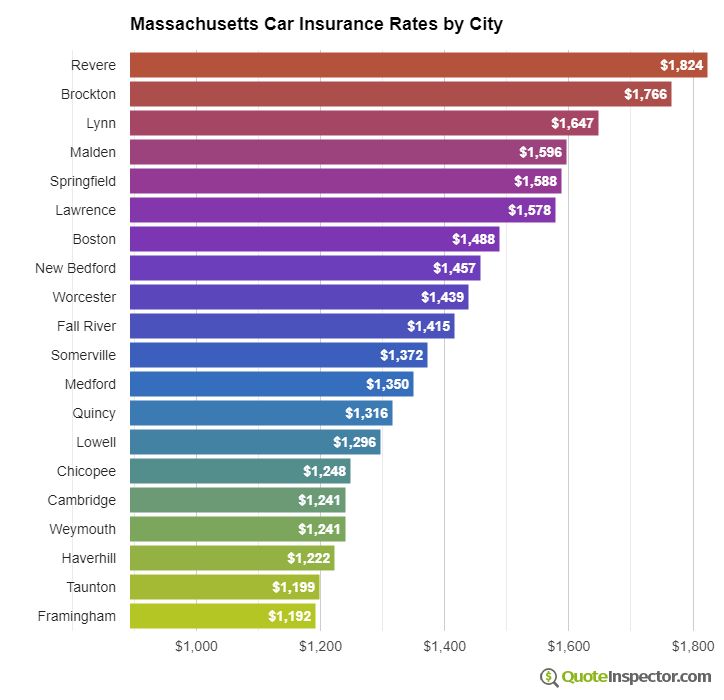

Location

The location where a driver resides or frequently drives in Massachusetts can also affect auto insurance rates. Urban areas with higher rates of accidents and theft may lead to higher premiums compared to rural areas with lower traffic congestion and crime rates. Additionally, factors like weather conditions and road infrastructure can also impact insurance costs.

Types of Vehicles, How much is auto insurance in massachusetts

The type of vehicle being insured also plays a role in determining auto insurance rates in Massachusetts. Generally, luxury cars, sports cars, and vehicles with high repair costs or theft rates may result in higher premiums. On the other hand, more affordable and safe vehicles typically lead to lower insurance costs.

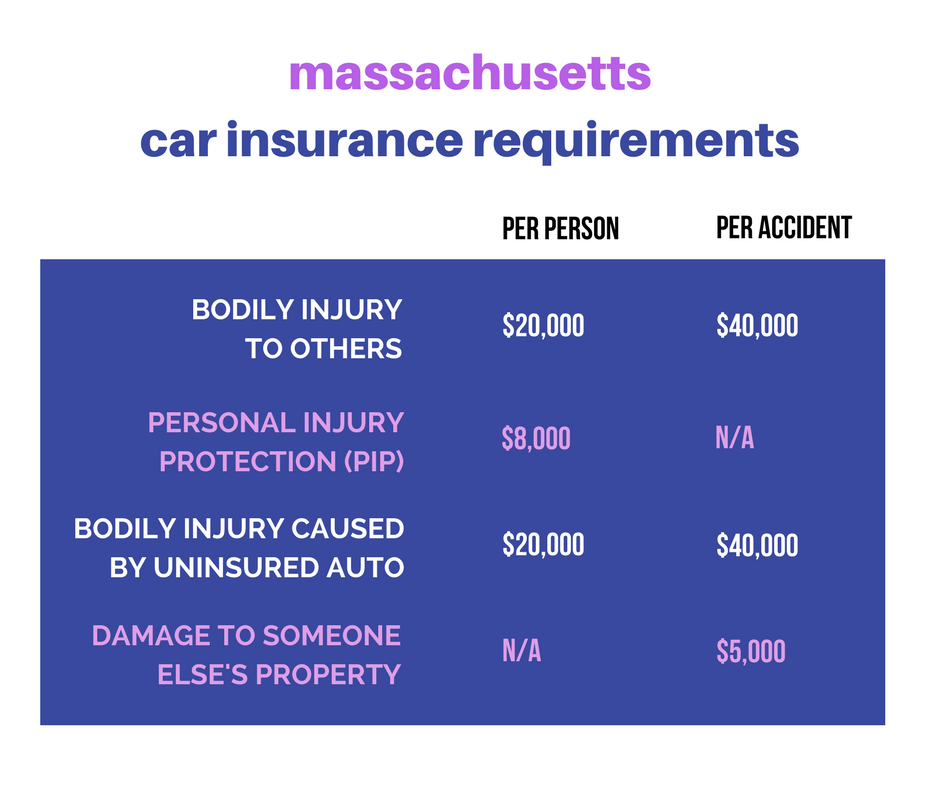

Minimum Auto Insurance Requirements in Massachusetts

In Massachusetts, all drivers are required by law to carry a minimum amount of auto insurance to ensure financial responsibility in case of an accident. This mandatory coverage includes liability insurance to cover damages and injuries caused to others in an accident.

Liability Coverage Limits

In Massachusetts, the minimum liability coverage limits for auto insurance are as follows:

– $20,000 per person for bodily injury

– $40,000 per accident for bodily injury

– $5,000 for property damage

These limits represent the minimum amount of insurance drivers must carry to legally operate a vehicle in Massachusetts. It is important to note that these limits may not provide adequate coverage in the event of a severe accident, and drivers may want to consider additional coverage options to protect themselves further.

Additional Coverage Options

Beyond the minimum liability coverage required by law, drivers in Massachusetts have the option to purchase additional coverage to enhance their protection. Some of the additional coverage options include:

– Collision coverage: This coverage helps pay for damages to your vehicle in the event of a collision with another vehicle or object.

– Comprehensive coverage: This coverage helps pay for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

– Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

By considering these additional coverage options, drivers can ensure they have adequate protection in various situations beyond the minimum requirements set by the state of Massachusetts.

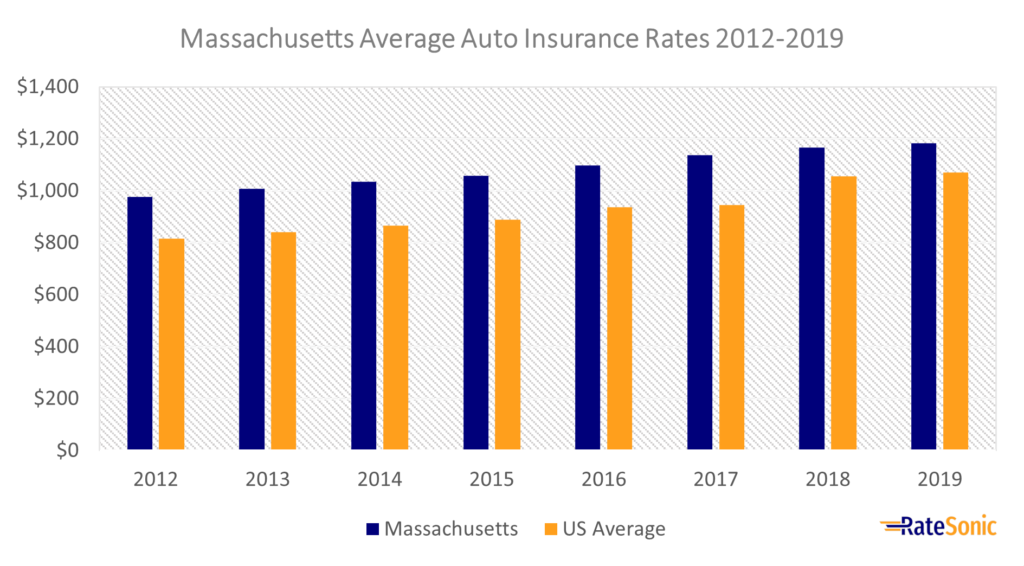

Average Cost of Auto Insurance in Massachusetts

When it comes to the average cost of auto insurance in Massachusetts, several factors come into play that can influence how much you pay for coverage. These factors can include your age, driving record, the type of vehicle you drive, and even where you live in the state. Understanding these variables can help you better estimate what you might expect to pay for auto insurance in Massachusetts.

Average Annual Premiums for Different Age Groups

In Massachusetts, the average annual premiums for auto insurance can vary based on the age group of the driver. Younger drivers, typically under the age of 25, tend to pay higher premiums due to their lack of driving experience and higher risk profile. On the other hand, older drivers, especially those over 50, may benefit from lower premiums due to their established driving history and experience.

Cost of Insurance Based on Type of Vehicle Insured

The type of vehicle you drive can also impact how much you pay for auto insurance in Massachusetts. Generally, more expensive or high-performance vehicles will cost more to insure compared to standard sedans or compact cars. Additionally, factors like the age of the vehicle, safety features, and the likelihood of theft can also influence insurance rates. It’s important to consider these factors when selecting a vehicle to ensure you can afford the associated insurance costs.

Tips for Saving on Auto Insurance in Massachusetts

When it comes to auto insurance in Massachusetts, there are various strategies drivers can implement to lower their insurance costs. By taking advantage of discounts, maintaining a good driving record, and exploring different policy options, individuals can potentially save money on their premiums.

Bundling Policies

- Consider bundling your auto insurance policy with other insurance policies, such as homeowners or renters insurance, from the same provider. Insurance companies often offer discounts for customers who purchase multiple policies from them.

Maintaining a Good Credit Score

- Insurance companies in Massachusetts may take your credit score into account when determining your auto insurance rates. By maintaining a good credit score, you may be eligible for lower premiums.

Defensive Driving Courses

- Completing a defensive driving course can not only help you become a safer driver but also qualify you for discounts on your auto insurance. Check with your insurance provider to see if they offer discounts for completing such courses.

Final Thoughts

In conclusion, understanding the nuances of auto insurance in Massachusetts can help you navigate the complexities of insurance policies and potentially save money in the process. Stay informed and make wise choices to ensure you have the coverage you need at a price you can afford.

Clarifying Questions: How Much Is Auto Insurance In Massachusetts

What factors affect auto insurance rates in Massachusetts?

The main factors include age, driving record, location, and the type of vehicle insured.

What are the minimum auto insurance requirements in Massachusetts?

Massachusetts law mandates liability coverage with specific limits. Additional coverage options are available beyond the minimum requirements.

How much does auto insurance cost on average in Massachusetts?

The average cost varies based on factors like age, driver profile, and the type of vehicle insured.

What tips can help save on auto insurance in Massachusetts?

Consider bundling policies, maintaining a good credit score, and taking defensive driving courses to potentially lower insurance costs. Look for discounts offered by insurance companies as well.