Workers compensation insurance california requirements are essential for businesses in the state. From mandatory coverage to penalties for non-compliance, this overview delves into the intricacies of this crucial topic.

Exploring the types of businesses that need coverage, exemptions, and minimum requirements, this guide provides a comprehensive look at workers’ compensation insurance in California.

Overview of Workers’ Compensation Insurance California Requirements

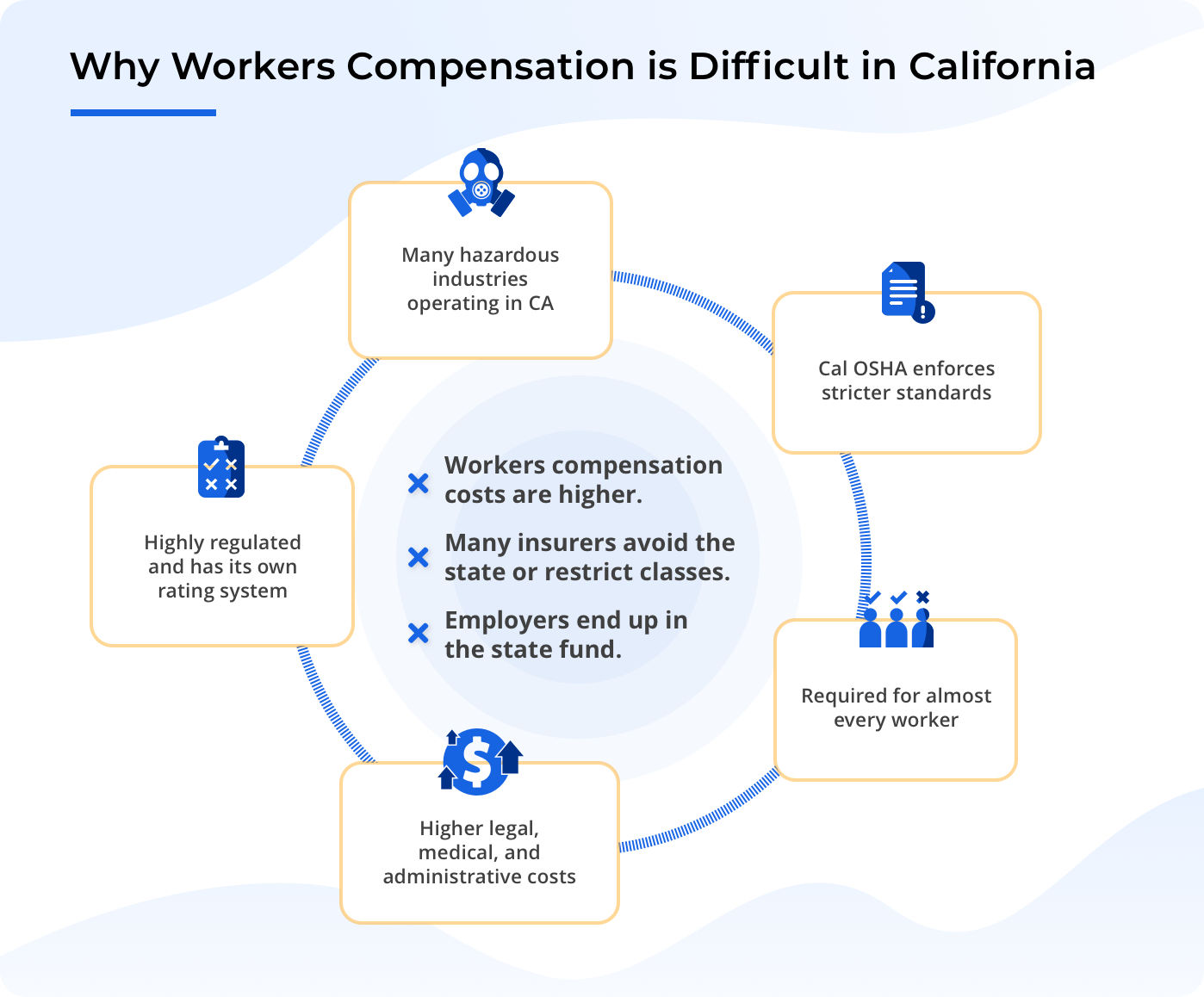

Workers’ compensation insurance is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses. In California, businesses are required to have workers’ compensation insurance to protect their employees and ensure they receive proper medical care and compensation for lost wages in case of a workplace injury.

Consequences of not having workers’ compensation insurance in California

- Fines and Penalties: Employers in California can face hefty fines and penalties for failing to carry workers’ compensation insurance.

- Lawsuits: Without workers’ compensation insurance, employers leave themselves open to lawsuits from employees who are injured on the job.

- Criminal Charges: In extreme cases, employers may even face criminal charges for not providing workers’ compensation insurance to their employees.

Mandatory Coverage and Exemptions: Workers Compensation Insurance California Requirements

In California, workers’ compensation insurance is mandatory for most employers, with some exceptions and exemptions in place to accommodate specific situations.

Types of Businesses Required to Carry Workers’ Compensation Insurance

- All businesses with employees, including part-time and full-time workers, are required to carry workers’ compensation insurance in California.

- This includes businesses of all sizes, from small local businesses to large corporations.

- Even family-owned businesses must provide coverage for their employees.

Exemptions and Exceptions to Mandatory Coverage

- Sole proprietors, partners in a partnership, and members of limited liability companies (LLCs) are not required to carry workers’ compensation insurance for themselves, but they may choose to do so.

- Certain types of employees, such as domestic workers, casual employees, and independent contractors, may be exempt from coverage requirements under specific conditions.

- Employers with no employees are generally not required to have workers’ compensation insurance.

Treatment of Independent Contractors

- Independent contractors are not considered employees, so they are typically not covered by workers’ compensation insurance provided by the hiring entity.

- However, misclassification of workers as independent contractors when they should be classified as employees can lead to legal issues and penalties for employers.

- It is crucial for businesses to correctly classify their workers to ensure compliance with workers’ compensation insurance requirements.

Minimum Requirements and Limits

In California, businesses are required to provide workers’ compensation insurance coverage to their employees to protect them in case of work-related injuries or illnesses. The state has specific minimum requirements and limits that businesses must adhere to in order to comply with California’s workers’ compensation laws.

Minimum Coverage Limits

- California law mandates that businesses must carry workers’ compensation insurance with a minimum coverage limit of $1 million per occurrence for bodily injury or illness.

- Employers must also have a minimum coverage limit of $100,000 per occurrence for property damage.

Specific Requirements for Compliance

- Businesses in California must obtain workers’ compensation insurance from a licensed insurance carrier or through the State Compensation Insurance Fund (SCIF).

- Employers are required to provide workers’ compensation benefits to all employees, including part-time, full-time, and temporary workers.

- Businesses must display the workers’ compensation poster in a prominent location at the workplace to inform employees of their rights and how to file a claim.

- Employers must report any work-related injuries or illnesses to their insurance carrier and the Division of Workers’ Compensation within a specified timeframe.

Variations Based on Business Size or Type

- Small businesses with less than 50 employees may have different requirements than larger corporations when it comes to workers’ compensation insurance.

- Certain industries, such as construction or healthcare, may have additional regulations or higher coverage limits due to the nature of the work and the increased risk of injuries.

- Business owners who are sole proprietors or partners may choose to exclude themselves from workers’ compensation coverage, but they must file a specific form with their insurance carrier to do so.

Penalties for Non-Compliance

Businesses in California that fail to comply with workers’ compensation insurance requirements can face severe penalties and consequences. It is essential for employers to understand the potential ramifications of not having proper coverage.

Penalties for Non-Compliance

- Penalties for non-compliance with workers’ compensation insurance requirements in California can include fines imposed by the state.

- Businesses may also face legal action, including lawsuits from employees who have been injured on the job and are not receiving the necessary benefits.

- Failure to provide workers’ compensation insurance can result in the suspension or revocation of business licenses, impacting the ability to operate legally.

Real-Life Examples of Consequences, Workers compensation insurance california requirements

- In 2019, a construction company in California was fined $100,000 for not having workers’ compensation insurance, leading to financial strain and reputation damage.

- A restaurant chain faced multiple lawsuits from employees who were injured at work and did not receive compensation due to lack of insurance, resulting in costly legal battles.

Financial Implications of Non-Compliance

- Businesses that do not comply with workers’ compensation laws in California may face significant financial implications, including hefty fines, legal fees, and potential settlements from lawsuits.

- The costs of non-compliance can far exceed the expenses of obtaining proper insurance coverage, putting businesses at risk of financial instability and even bankruptcy.

- Furthermore, non-compliance can damage the reputation of a business, leading to loss of trust from employees, customers, and the community, impacting long-term success.

Final Conclusion

In conclusion, understanding and meeting workers’ compensation insurance requirements in California is vital for businesses to protect both employees and the company. Stay informed and compliant to ensure a smooth operation.

User Queries

What businesses are required to have workers’ compensation insurance in California?

Most businesses with employees are required to have workers’ compensation insurance in California, including those with part-time or full-time workers.

Are independent contractors subject to workers’ compensation insurance requirements?

Independent contractors are generally not covered by workers’ compensation insurance requirements in California, as they are considered self-employed.

What are the penalties for not complying with workers’ compensation insurance requirements?

Businesses that do not comply with workers’ compensation insurance requirements in California may face fines, legal action, and even suspension of operations.