Introduction

In macroeconomics and business strategy, understanding the relationship between national income, spending, and inventories is crucial. The Y = AE model (also known as the income-expenditure model) offers powerful insights into how firms manage inventories in response to changing levels of demand and production. While traditionally taught in economic theory, this model has practical applications in real-world inventory management.

This article explores the connection between business inventories and the Y = AE model, illustrating how this relationship shapes business decisions, economic output, and market stability.

Table of Contents

-

Introduction

-

Understanding Business Inventories

-

What Is the Y-AE Model?

-

Components of the Aggregate Expenditure (AE) Model

-

The Role of Inventories in the Y-AE Framework

-

Equilibrium in the Y = AE Model

-

Inventory Adjustments and Business Decisions

-

Real-World Application of the Y = AE Model in Inventory Planning

-

Inventory Buildup and Depletion: Signals from the Economy

-

Inventory and Output: How They Influence GDP

-

Using the Y = AE Model to Predict Inventory Behavior

-

Business Cycles and Inventory Fluctuations

-

Policy Implications: How Governments Affect Inventories through AE

-

Challenges in Applying the Y = AE Model to Real Inventory Systems

-

Technology and Data Analytics in Inventory and AE Management

-

Case Study: Applying Y = AE in Retail Inventory Strategy

-

Best Practices for Businesses Integrating AE into Inventory Planning

-

The Future of Inventory Management with Economic Models

-

Conclusion

Understanding Business Inventories

Business inventories are goods that companies keep in stock for future sales or production. They include:

-

Raw materials: Inputs for manufacturing.

-

Work-in-progress (WIP): Products in production.

-

Finished goods: Items ready for sale.

Efficient inventory management ensures that firms can meet demand without overstocking, which ties up capital and increases holding costs. On the other hand, understocking can result in lost sales and damaged customer relationships.

What Is the Y-AE Model?

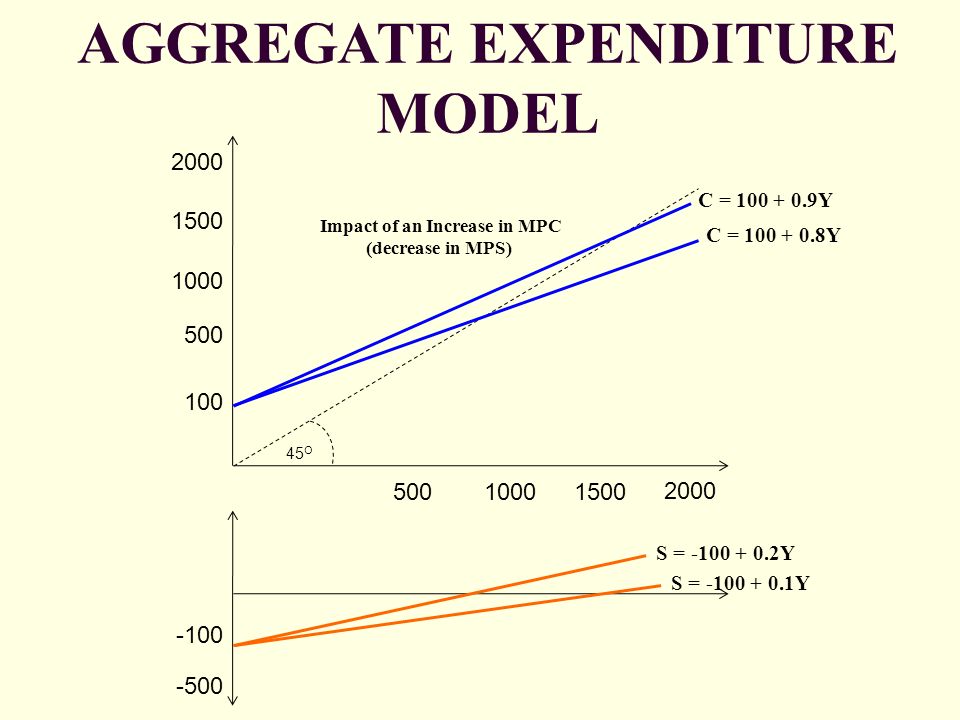

The Y = AE model represents macroeconomic equilibrium where:

-

Y is the national income or output (GDP).

-

AE is the aggregate expenditure, or total spending in the economy.

When output (Y) equals spending (AE), the economy is in equilibrium. If Y > AE, inventories rise, signaling businesses to cut production. If Y < AE, inventories fall, prompting firms to increase output.

This model plays a central role in Keynesian economics, focusing on the demand side of the economy and its impact on output and employment.

Components of the Aggregate Expenditure (AE) Model

The AE model includes the following components:

-

C = Consumption – Household spending on goods and services.

-

I = Investment – Business spending on capital and inventories.

-

G = Government Spending – Public expenditure on infrastructure, salaries, etc.

-

NX = Net Exports – Exports minus imports (X – M).

So,

AE = C + I + G + NX

This equation reflects the total planned spending in an economy. Inventory levels act as the balancing mechanism between planned expenditure and actual output.

The Role of Inventories in the Y-AE Framework

In the Y = AE model, inventories are crucial because they represent the difference between planned spending and actual production.

-

If firms produce more than is sold, inventories accumulate.

-

If firms produce less than is sold, inventories decrease.

This signals to businesses whether to increase or decrease production in the future.

Inventory as an Automatic Stabilizer

Inventories allow businesses to temporarily absorb fluctuations in demand without immediately adjusting production, acting as a buffer in the economic system.

Equilibrium in the Y = AE Model

The economy reaches equilibrium when:

Actual output (Y) = Planned aggregate expenditure (AE)

At this point:

-

There is no unplanned change in inventories.

-

Firms are satisfied with their current level of production.

-

The economy is stable in the short run.

If this balance is disturbed, inventory levels indicate the direction in which production should move to restore equilibrium.

Inventory Adjustments and Business Decisions

Inventory changes provide vital feedback to businesses:

-

Rising inventories → Overproduction → Businesses reduce output.

-

Falling inventories → Underproduction → Businesses increase output.

By monitoring changes in real-time sales vs. production, businesses make strategic decisions about labor, investment, and logistics.

Real-World Application of the Y = AE Model in Inventory Planning

Though theoretical, the Y = AE model has practical implications in inventory management. Companies can use it to:

-

Adjust production schedules.

-

Forecast inventory needs during economic cycles.

-

Align resource allocation with consumer demand.

Example: During a recession (AE drops), businesses observe rising inventories and cut production to prevent losses.

Inventory Buildup and Depletion: Signals from the Economy

Inventory Buildup:

Occurs when consumers reduce spending unexpectedly, causing planned sales to fall short. Businesses must cut production or discount excess stock.

Inventory Depletion:

Occurs when demand outpaces expectations. Firms respond by ramping up production or placing urgent orders, often at higher costs.

Economists monitor inventory-to-sales ratios to assess business health and future growth trends.

Inventory and Output: How They Influence GDP

Changes in inventories are counted as part of gross private domestic investment, which contributes to GDP. Therefore:

-

Inventory accumulation increases GDP (even if unsold).

-

Inventory reduction subtracts from GDP.

This can cause GDP to fluctuate independently of actual sales, highlighting the importance of accurate inventory planning.

Using the Y = AE Model to Predict Inventory Behavior

Firms can forecast inventory trends by:

-

Analyzing consumer confidence and disposable income (C).

-

Monitoring business investment trends (I).

-

Assessing government spending patterns (G).

-

Tracking exports/imports (NX).

By projecting future AE, businesses can adjust production proactively, reducing the risk of unexpected inventory changes.

Business Cycles and Inventory Fluctuations

Inventory behavior varies across business cycles:

Expansion Phase

-

Demand increases.

-

Inventories fall.

-

Firms increase output.

Peak Phase

-

Demand plateaus.

-

Inventories stabilize or start rising.

Recession Phase

-

Demand drops.

-

Inventories rise sharply.

-

Firms cut production.

Trough Phase

-

Inventories are low.

-

Demand recovery begins.

-

Firms slowly increase production.

Understanding these phases helps firms adjust strategies in time.

Policy Implications: How Governments Affect Inventories through AE

Governments influence AE—and by extension inventories—through:

-

Fiscal policy (e.g., tax cuts or spending increases)

-

Monetary policy (e.g., lowering interest rates to boost investment)

Stimulus measures increase AE, reduce excess inventories, and prompt firms to expand production.

Challenges in Applying the Y = AE Model to Real Inventory Systems

While useful, the Y = AE model has limitations:

-

Assumes constant prices – real markets face inflation and deflation.

-

Ignores supply constraints – production may not respond immediately to changes in demand.

-

Simplified behavioral assumptions – consumer and firm behavior is often unpredictable.

To address these, businesses should integrate the model with market data, technology, and behavioral insights.

Technology and Data Analytics in Inventory and AE Management

Modern businesses use tools like:

-

ERP systems

-

Big data analytics

-

AI-based forecasting

-

Cloud inventory platforms

These technologies help firms:

-

Monitor sales in real time.

-

Adjust output instantly.

-

Predict demand based on AE components.

This bridges the gap between economic models and real-world decisions.

Case Study: Applying Y = AE in Retail Inventory Strategy

Background:

A retail chain noticed rising inventory levels despite strong economic data. Using the Y = AE framework, they examined:

-

AE trends: Consumer spending on luxury goods was declining.

-

Inventory levels: High in non-essential categories.

-

Action taken: Shifted focus to basic consumer staples.

Result:

They avoided losses by aligning their product mix with the updated AE data, demonstrating how macroeconomic models can drive tactical retail decisions.

Best Practices for Businesses Integrating AE into Inventory Planning

-

Regularly analyze AE components to understand market demand.

-

Track inventory-to-sales ratios to detect early imbalances.

-

Incorporate scenario analysis for recession or expansion phases.

-

Use integrated dashboards that link economic forecasts with inventory metrics.

-

Train finance and operations teams on using economic models for decision-making.

The Future of Inventory Management with Economic Models

As data becomes more accessible and AI systems more advanced, models like Y = AE will evolve from theoretical tools into real-time decision frameworks for inventory planning.

Key Trends:

-

Automated economic dashboards for business executives.

-

AI-powered economic simulations for inventory planning.

-

Integration of macroeconomic indicators into ERP systems.

In the future, firms that blend macroeconomic insight with supply chain agility will gain a competitive edge.

Conclusion

The Y = AE model provides a fundamental lens through which businesses can interpret and react to changes in demand, production, and inventory levels. While rooted in economics, its relevance in practical inventory management is profound.

By understanding the dynamics between aggregate expenditure and output, businesses can make smarter decisions, avoid costly overstocking or understocking, and navigate economic uncertainty with greater confidence.

In a world of fluctuating markets, the key to inventory success lies in combining economic theory with real-time data and technology—transforming models like Y = AE into strategic assets for modern enterprises.