Car insurance Baldwinsville NY sets the stage for understanding the ins and outs of insurance coverage in this area. From key factors affecting rates to finding affordable options, this comprehensive guide delves into all aspects to help you navigate the world of car insurance with ease.

Exploring the nuances of car insurance in Baldwinsville, NY provides a wealth of information crucial for making informed decisions. Dive into the details to uncover valuable insights and tips for securing the right coverage for your needs.

Overview of Car Insurance in Baldwinsville, NY

Car insurance is a crucial aspect of financial planning for vehicle owners in Baldwinsville, NY. It provides protection against financial losses in the event of accidents, theft, or other unforeseen incidents on the road. Having car insurance is not only a legal requirement but also offers peace of mind and security for drivers and their vehicles.

Importance of Car Insurance

Car insurance is essential to safeguard drivers and their vehicles from unexpected expenses that can arise from accidents or damages. It helps cover medical bills, repair costs, and legal fees that may result from accidents. Without proper insurance coverage, drivers may face significant financial burdens that could have long-lasting consequences.

Statistics on Car Insurance Coverage in Baldwinsville, NY, Car insurance baldwinsville ny

According to recent data, a significant percentage of drivers in Baldwinsville, NY, have car insurance coverage. This reflects the responsible behavior of vehicle owners in ensuring financial protection for themselves and others on the road. The statistics indicate a high level of awareness regarding the importance of car insurance in the community.

Common Types of Car Insurance Policies Available

In Baldwinsville, NY, drivers have access to various types of car insurance policies to suit their individual needs. Some common types include:

- Liability Insurance: Covers damages and injuries to others in an accident where the policyholder is at fault.

- Collision Coverage: Pays for repairs or replacement of the policyholder’s vehicle in case of a collision.

- Comprehensive Insurance: Provides coverage for non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects the policyholder if involved in an accident with a driver who has insufficient or no insurance.

These policies offer different levels of protection and coverage options, allowing drivers to select the one that best meets their insurance needs and budget constraints.

Factors Affecting Car Insurance Rates in Baldwinsville, NY

When it comes to car insurance rates in Baldwinsville, NY, several key factors come into play. Understanding how these factors influence insurance premiums can help you make informed decisions when selecting a policy.

Age, Driving Record, and Vehicle Type:

Age, driving record, and vehicle type are significant factors that impact car insurance rates. Younger drivers typically face higher premiums due to their lack of driving experience, while drivers with a history of accidents or traffic violations may also see increased rates. Additionally, the type of vehicle you drive can affect your insurance costs, with more expensive or high-performance cars often leading to higher premiums.

Location and Local Factors:

The location where you live and drive in Baldwinsville, NY, can also play a role in determining your car insurance costs. Urban areas with higher rates of crime or traffic congestion may result in higher premiums compared to rural areas with lower risk factors. Local factors such as weather conditions, road infrastructure, and population density can all impact insurance rates.

Impact of Age on Car Insurance Rates

Age is a crucial factor that insurers consider when determining car insurance rates. Younger drivers, particularly those under the age of 25, often face higher premiums due to their perceived higher risk of being involved in accidents. As drivers age and gain more experience behind the wheel, insurance rates typically decrease. This is because older drivers are generally seen as more responsible and less likely to engage in risky driving behavior.

- Young drivers under 25 may face higher insurance premiums.

- Older drivers with more experience usually enjoy lower rates.

- Insurance companies view age as an indicator of driving risk.

Role of Driving Record in Insurance Costs

Your driving record is a critical factor that insurers use to assess your risk level and determine your car insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums, as it indicates responsible and safe driving habits. On the other hand, a history of accidents, speeding tickets, or DUI convictions can result in increased insurance costs due to the higher perceived risk associated with such drivers.

- Accidents and traffic violations can lead to higher insurance rates.

- Drivers with a clean record are often rewarded with lower premiums.

- Insurance companies consider past driving behavior when setting rates.

Vehicle Type and Insurance Premiums

The type of vehicle you drive can significantly impact your car insurance rates. Insurers take into account factors such as the make and model of your car, its age, safety features, and market value when calculating premiums. Expensive or high-performance vehicles tend to have higher insurance costs due to the increased risk of theft, damage, or costly repairs associated with these types of cars.

| Factor | Impact |

|---|---|

| Vehicle make and model | Determines insurance rates based on repair costs and safety features. |

| Car age | Older cars may have lower premiums due to lower market value. |

| Safety features | Cars equipped with advanced safety features may qualify for discounts. |

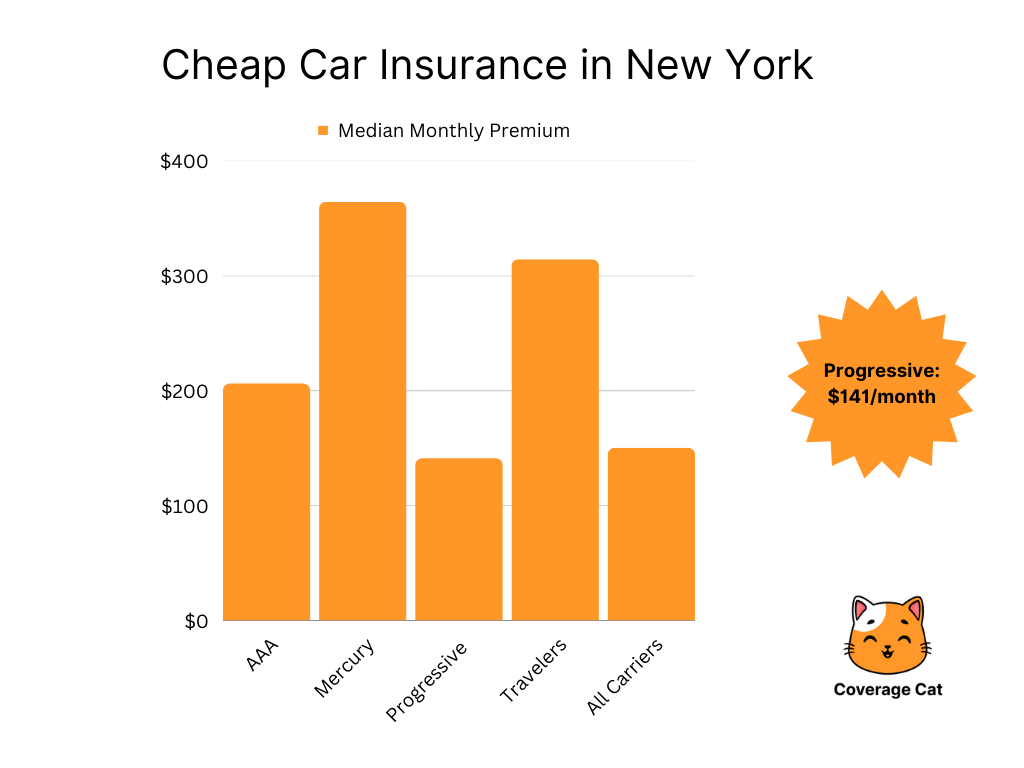

Finding Affordable Car Insurance in Baldwinsville, NY: Car Insurance Baldwinsville Ny

When looking for affordable car insurance in Baldwinsville, NY, there are several strategies you can use to lower your premiums and take advantage of discounts and savings opportunities available in the area.

Tips for Lowering Car Insurance Premiums

- Compare quotes from multiple insurance providers to find the best rate.

- Consider raising your deductible to lower your monthly premiums.

- Maintain a clean driving record to qualify for lower rates.

- Ask about available discounts for safe driving habits, such as usage-based insurance programs.

- Bundle your car insurance with other policies, such as homeowners or renters insurance, for additional savings.

Discounts and Savings Opportunities

- Many insurance companies offer discounts for completing defensive driving courses.

- Students with good grades may qualify for a discount on their car insurance premiums.

- Some insurers offer discounts for installing anti-theft devices in your vehicle.

- Ask your insurance provider about loyalty discounts for staying with the same company for multiple years.

- Explore options for low-mileage discounts if you don’t drive your car frequently.

Comparison of Insurance Providers

| Insurance Provider | Offerings |

|---|---|

| ABC Insurance | Offers competitive rates for drivers with clean records and multiple policy discounts. |

| XYZ Insurance | Specializes in providing discounts for students and safe drivers. |

| 123 Insurance | Known for personalized customer service and loyalty rewards for long-time customers. |

Understanding Car Insurance Laws and Requirements in Baldwinsville, NY

Car insurance laws and requirements vary by state, including in Baldwinsville, NY. It is crucial to understand the minimum car insurance requirements, consequences of driving without proper coverage, and any specific regulations that apply in the area.

Minimum Car Insurance Requirements in Baldwinsville, NY

In Baldwinsville, NY, drivers are required to carry a minimum amount of liability insurance. The minimum coverage typically includes:

- Bodily Injury Liability: $25,000 per person and $50,000 per accident

- Property Damage Liability: $10,000 per accident

These minimum requirements ensure that drivers have financial protection in case they are at fault in an accident.

Consequences of Driving Without Proper Insurance Coverage

Driving without proper insurance coverage in Baldwinsville, NY can result in severe consequences. Some of the repercussions may include:

- Fines and Penalties: Drivers caught without insurance may face fines and penalties imposed by the state.

- License Suspension: Your driver’s license may be suspended if you are found driving without insurance.

- Legal Issues: Driving without insurance can lead to legal troubles and potential lawsuits if you are involved in an accident.

It is essential to have the required insurance coverage to avoid these consequences.

Specific Laws or Regulations in Baldwinsville, NY

In addition to the minimum insurance requirements, Baldwinsville, NY may have specific laws or regulations related to car insurance. These laws could include:

- No-Fault Insurance: New York is a no-fault state, meaning that each driver’s insurance typically covers their injuries and damages regardless of fault.

- Uninsured Motorist Coverage: Drivers in Baldwinsville may be required to have uninsured motorist coverage to protect themselves in case of an accident with an uninsured driver.

Understanding these specific laws and regulations can help drivers navigate the car insurance landscape in Baldwinsville, NY effectively.

Last Point

As we conclude this exploration of car insurance in Baldwinsville, NY, remember that being well-informed is the key to making smart choices. With the knowledge gained from this guide, you’re now better equipped to navigate the realm of car insurance confidently and efficiently.

Questions Often Asked

What are the minimum car insurance requirements in Baldwinsville, NY?

In Baldwinsville, NY, drivers are required to have at least the state’s minimum liability coverage, which includes Bodily Injury and Property Damage limits.

How do age and driving record affect car insurance rates in Baldwinsville, NY?

Younger drivers and those with a poor driving record typically face higher insurance rates due to a higher perceived risk of accidents.

Are there specific laws regarding car insurance in Baldwinsville, NY?

Baldwinsville, NY follows New York state laws on car insurance, including mandatory liability coverage and penalties for driving without insurance.