Starting with humana health insurance medicare supplement, this comprehensive guide delves into the details of coverage, benefits, and more.

Exploring the different plan types, enrollment process, network coverage, costs, and pricing of Humana Health Insurance Medicare Supplement will provide you with the necessary information to make an informed decision.

Overview of Humana Health Insurance Medicare Supplement

Humana Health Insurance offers a Medicare Supplement plan designed to fill the coverage gaps left by Original Medicare. This supplemental insurance helps pay for out-of-pocket costs such as copayments, coinsurance, and deductibles that Medicare doesn’t cover.

Coverage provided by Humana Health Insurance Medicare Supplement

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- First three pints of blood

- Hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

Benefits of choosing Humana Health Insurance

- Wide network of healthcare providers

- Additional benefits like fitness programs and preventive care services

- Financial protection from high medical costs

- Excellent customer service and support

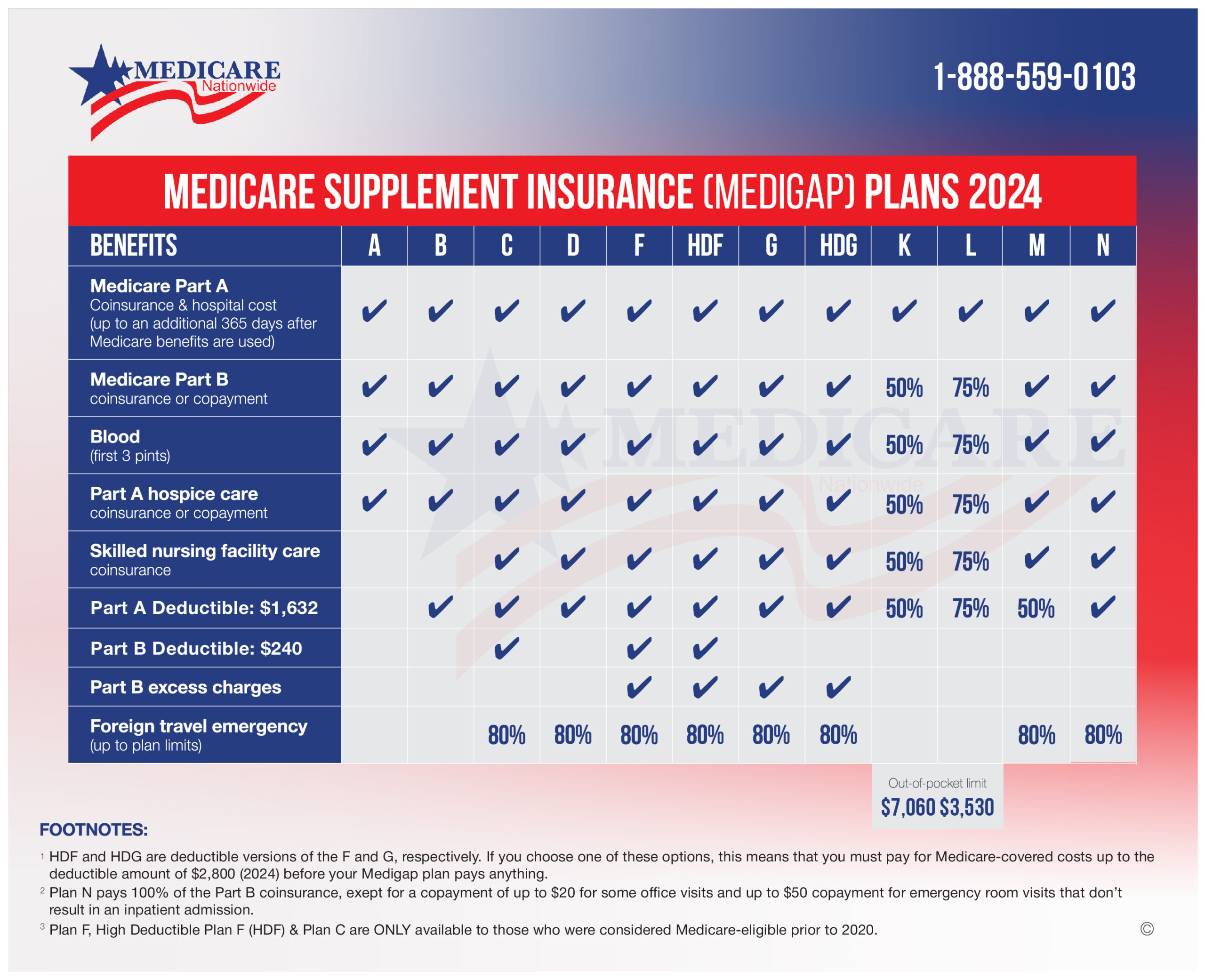

Types of Plans Offered by Humana

When it comes to Medicare Supplement plans, Humana offers a variety of options to cater to different needs and budgets. Let’s take a closer look at the types of plans offered by Humana and compare their coverage and costs to help you make an informed decision.

Plan A

- Plan A is the most basic Medicare Supplement plan offered by Humana.

- It provides coverage for basic benefits such as Medicare Part A coinsurance and hospital costs.

- Plan A typically has lower premiums compared to other plans, making it a cost-effective option for those seeking minimal coverage.

Plan F

- Plan F is the most comprehensive Medicare Supplement plan available, covering all out-of-pocket costs not covered by Original Medicare.

- This plan offers the highest level of coverage, including deductibles, copayments, and coinsurance.

- While Plan F provides extensive coverage, it also tends to have higher premiums compared to other plans.

Plan G

- Plan G is similar to Plan F but does not cover the Medicare Part B deductible.

- It offers comprehensive coverage for other out-of-pocket costs, making it a popular choice among beneficiaries looking for substantial coverage at a lower cost.

- Plan G may have lower premiums compared to Plan F, making it a more affordable option for some individuals.

Plan N

- Plan N is a cost-effective option that covers most out-of-pocket costs but requires beneficiaries to pay copayments for some services.

- While Plan N offers comprehensive coverage, it may involve more cost-sharing than Plans F and G.

- Plan N typically has lower premiums compared to Plans F and G, making it a budget-friendly choice for many beneficiaries.

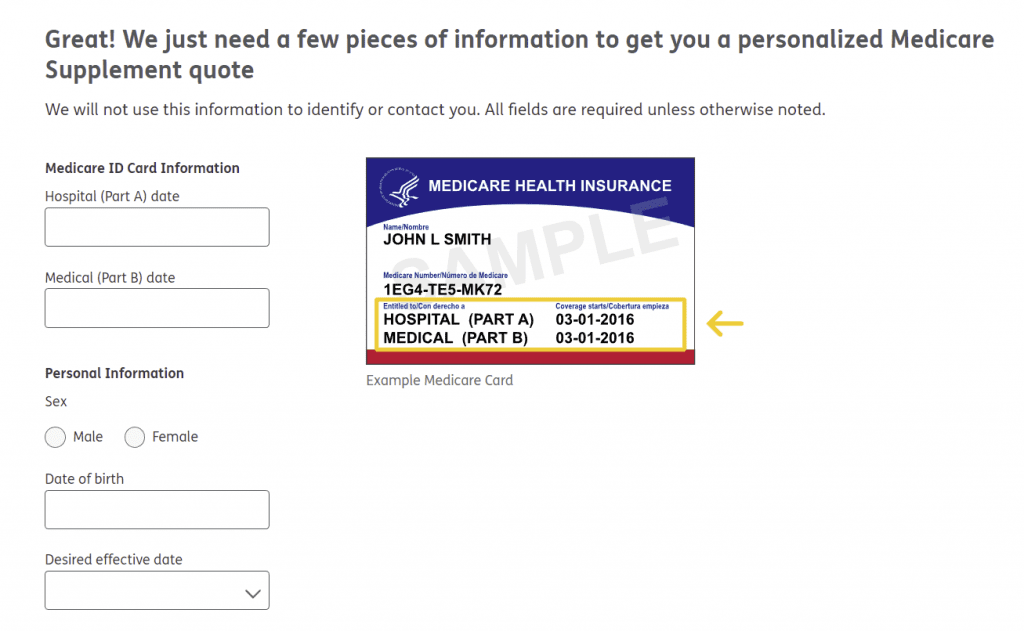

Enrollment Process: Humana Health Insurance Medicare Supplement

When it comes to enrolling in a Humana Health Insurance Medicare Supplement plan, there are specific steps you need to follow to ensure a smooth and successful process. Below, we Artikel the enrollment process, eligibility criteria, and any special considerations you should be aware of.

Steps to Enroll in a Humana Plan

- Visit the official Humana website or contact a Humana representative to explore available plans in your area.

- Compare the different Medicare Supplement plans offered by Humana to determine which one best suits your needs.

- Once you have chosen a plan, complete the enrollment application either online, over the phone, or through the mail.

- Provide any necessary personal and medical information required for enrollment.

- Review your application carefully before submitting it to ensure accuracy and completeness.

- Wait for confirmation of your enrollment from Humana, along with details about your coverage and benefits.

Eligibility Criteria for Enrolling in Humana Plans

- To enroll in a Humana Health Insurance Medicare Supplement plan, you must be enrolled in Medicare Part A and Part B.

- You must also be a resident in the state where you are applying for coverage.

- Some plans may have additional eligibility requirements based on age or health status.

Special Enrollment Periods and Considerations

- There are certain circumstances, such as losing other health coverage or moving to a new area, that may qualify you for a special enrollment period with Humana.

- During a special enrollment period, you may be able to enroll in a Humana plan outside of the regular enrollment periods.

- It’s important to be aware of any special considerations or deadlines that apply to your specific situation to ensure you can enroll in a timely manner.

Network Coverage and Providers

When considering Humana Health Insurance Medicare Supplement plans, it is essential to understand the network coverage and providers included. This information can greatly impact your access to healthcare services and potential cost savings.

Network Coverage

Humana Health Insurance Medicare Supplement plans typically offer broad network coverage, including a wide range of healthcare providers and facilities. This means that you have the flexibility to choose from various doctors, specialists, hospitals, and other healthcare providers within the network.

- Primary care physicians

- Specialists (such as cardiologists, dermatologists, etc.)

- Hospitals

- Diagnostic centers

- Urgent care facilities

- Pharmacies

Finding In-Network Providers

To maximize your coverage and cost savings, it is important to seek care from in-network providers whenever possible. You can easily find in-network providers by using Humana’s online provider directory or by contacting customer service for assistance. By choosing in-network providers, you can benefit from lower out-of-pocket costs and ensure that your services are covered by your Medicare Supplement plan.

Cost and Pricing

When it comes to Humana Health Insurance Medicare Supplement plans, understanding the costs involved is crucial for making informed decisions about your healthcare coverage.

Cost Breakdown

- Monthly Premiums: The amount you pay each month for your Medicare Supplement plan. Premiums can vary based on the plan you choose and your location.

- Out-of-Pocket Costs: This includes deductibles, copayments, and coinsurance that you are responsible for paying when you receive healthcare services.

- Plan Type: Different plan options offered by Humana have varying costs, with more comprehensive coverage typically coming with higher premiums.

Determining Pricing, Humana health insurance medicare supplement

- Pricing for Humana Health Insurance Medicare Supplement plans is determined based on factors such as your age, location, gender, and whether you smoke.

- Plan Options: The level of coverage and benefits provided by each plan will impact the pricing, with more extensive coverage generally resulting in higher premiums.

- Community Rating: Humana uses community rating, where everyone in the same geographic area pays the same premium for the same plan, regardless of age.

Managing Costs and Saving Money

- Review Your Coverage: Periodically review your healthcare needs to ensure you are not paying for coverage you don’t need.

- Utilize In-Network Providers: Opting for healthcare providers within Humana’s network can help you save on out-of-pocket costs.

- Consider High-Deductible Plans: If you are in good health and don’t anticipate frequent medical expenses, a high-deductible plan may offer lower premiums.

- Health Savings Accounts (HSAs): If eligible, consider pairing your Medicare Supplement plan with an HSA to save on healthcare expenses with tax advantages.

Final Review

In conclusion, Humana Health Insurance Medicare Supplement offers a range of benefits and coverage options tailored to individual needs, ensuring comprehensive healthcare solutions for Medicare beneficiaries.

FAQ Guide

How do I enroll in a Humana Health Insurance Medicare Supplement plan?

To enroll, you can follow the steps Artikeld on the Humana website or contact their customer service for assistance.

What are the eligibility criteria for enrolling in Humana plans?

Eligibility criteria may vary, but generally, individuals must be Medicare beneficiaries to enroll in Humana Health Insurance Medicare Supplement plans.

Are there special enrollment periods for Humana plans?

Yes, there are specific enrollment periods, such as the Initial Enrollment Period and Special Enrollment Periods, where you can sign up for a Humana plan.

How can I find in-network providers with Humana Health Insurance?

You can use the provider search tool on the Humana website or contact customer service to locate in-network healthcare providers for better coverage and cost savings.

What are some tips for managing costs with Humana Health Insurance Medicare Supplement?

Managing costs can be done by choosing a plan that aligns with your needs, utilizing in-network providers, and exploring potential ways to save on premiums offered by Humana.