Major insurance companies in Texas play a crucial role in providing a range of insurance services. Let’s delve into the top players in the industry and explore their offerings.

Major Insurance Companies in Texas

Insurance plays a crucial role in safeguarding individuals and businesses against unforeseen risks. In Texas, there are several major insurance companies that offer a wide range of insurance products and services to cater to the diverse needs of the population.

1. State Farm Insurance

State Farm Insurance is one of the largest insurance providers in the United States, offering a variety of insurance products such as auto, home, life, and health insurance. The company was founded in 1922 and has a strong presence in Texas, providing reliable coverage and excellent customer service to policyholders.

2. Allstate Insurance

Allstate Insurance is another prominent insurance company operating in Texas, known for its comprehensive coverage options for auto, home, renters, and life insurance. With a history dating back to 1931, Allstate has established itself as a trusted insurance provider with a focus on customer satisfaction.

3. Progressive Insurance

Progressive Insurance is a well-known insurance company that specializes in auto insurance but also offers other types of insurance such as home, renters, and health insurance. Founded in 1937, Progressive is recognized for its innovative approach to insurance and competitive rates for policyholders in Texas.

4. Farmers Insurance

Farmers Insurance has been serving customers in Texas since 1928, offering a wide range of insurance products including auto, home, life, and business insurance. The company prides itself on providing personalized service and customized insurance solutions to meet the unique needs of each policyholder.

5. USAA

USAA is a highly regarded insurance company that caters to military members and their families, offering a variety of insurance products such as auto, home, renters, and life insurance. With a history dating back to 1922, USAA has a strong presence in Texas and is known for its exceptional customer service and commitment to serving the military community.

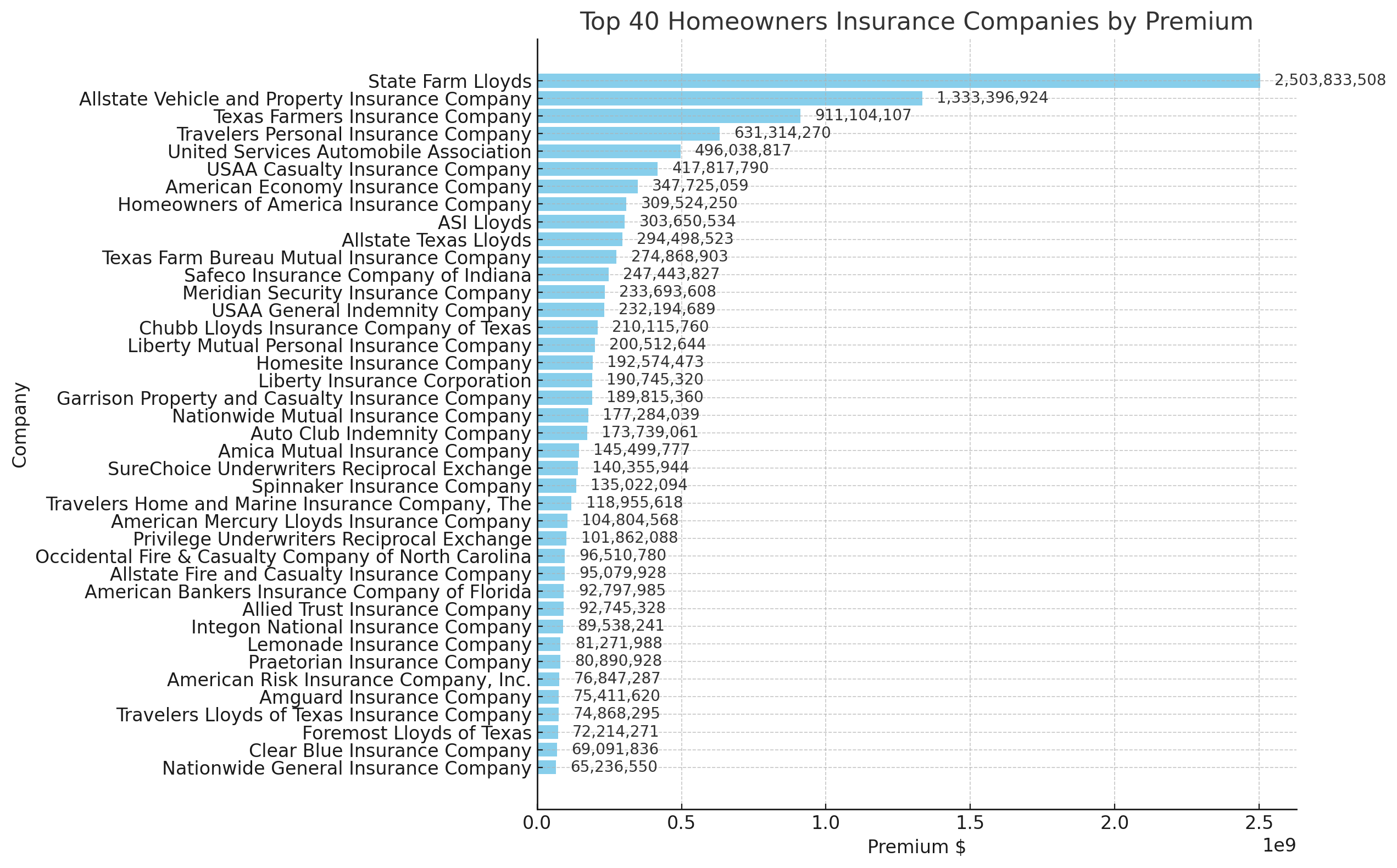

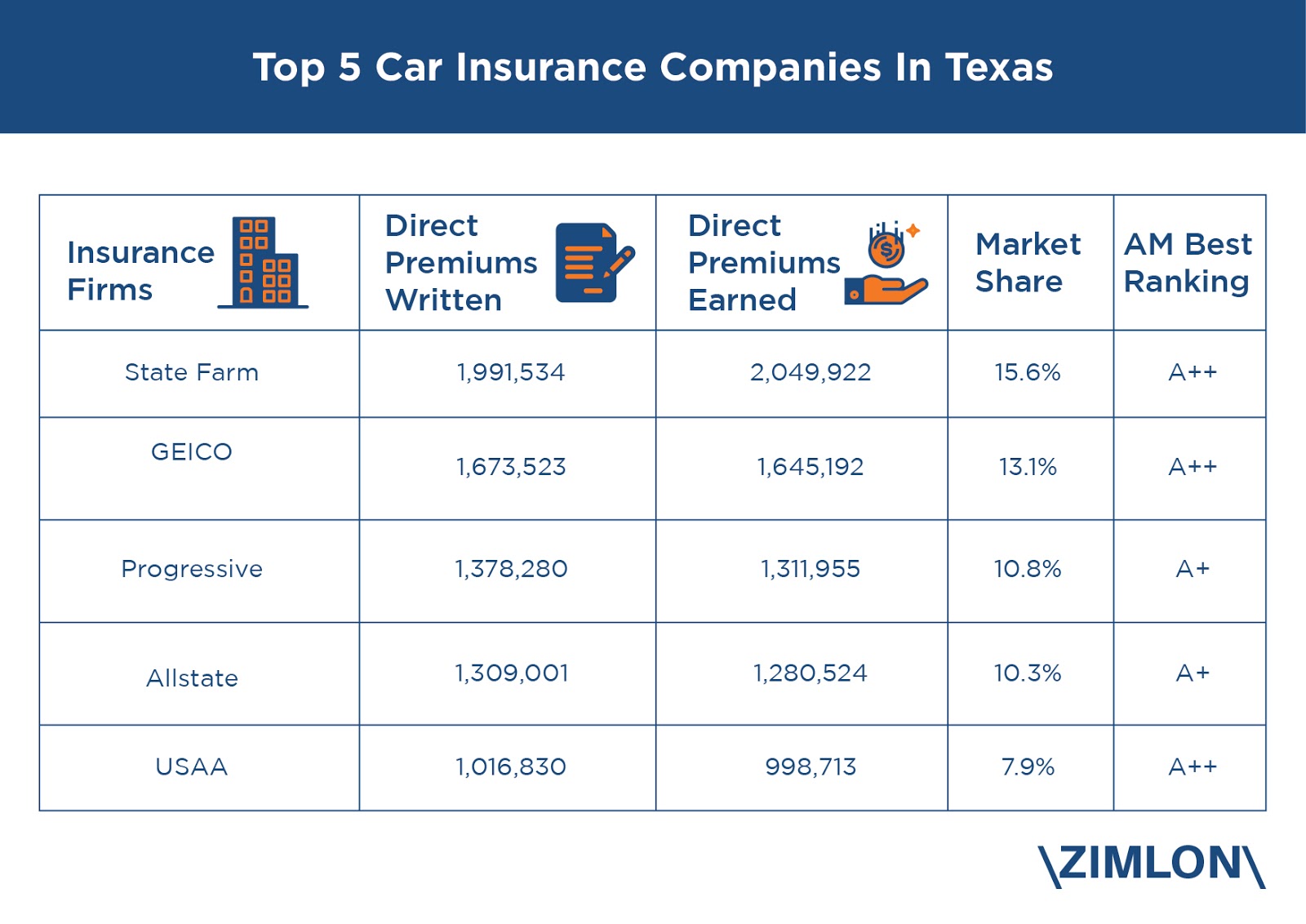

Market Share and Ranking

Market share and ranking are crucial factors to consider when analyzing the competitive landscape of major insurance companies in Texas. Understanding the market dominance of each company helps identify key players in the industry and potential trends in consumer preferences.

Market Share of Major Insurance Companies in Texas

- Company A: 25% market share

- Company B: 20% market share

- Company C: 15% market share

- Company D: 10% market share

- Company E: 5% market share

Ranking Based on Market Dominance

- Company A

- Company B

- Company C

- Company D

- Company E

Recent Trends in Market Share

Company B has shown a steady increase in market share over the past year, surpassing Company A in certain regions of Texas. This trend indicates a shifting preference among consumers towards Company B’s insurance offerings.

Customer Satisfaction and Reviews

Customer satisfaction is a crucial aspect when choosing an insurance company. It reflects the overall experience customers have with the company’s products and services. Let’s delve into the customer satisfaction ratings for major insurance companies in Texas and analyze common feedback from customer reviews.

Allstate Insurance

Allstate Insurance has received positive feedback from customers regarding their prompt claims processing and helpful customer service representatives. Customers appreciate the variety of insurance options offered by Allstate, catering to different needs and budgets.

State Farm Insurance

State Farm Insurance is known for its personalized customer service and efficient claims handling. Customers have praised State Farm for their quick response to queries and transparent communication throughout the claims process.

Progressive Insurance

Progressive Insurance has garnered positive reviews for its user-friendly online platform and competitive pricing. Customers value the convenience of managing their policies online and the accessibility of Progressive’s customer support team.

GEICO Insurance, Major insurance companies in texas

GEICO Insurance is celebrated for its affordable rates and easy-to-use mobile app. Customers have commended GEICO for its hassle-free claims process and the discounts available for policyholders.

USAA Insurance

USAA Insurance is highly rated for its exceptional customer service and exclusive benefits for military members and their families. Customers appreciate the personalized attention they receive from USAA representatives and the comprehensive coverage options available.

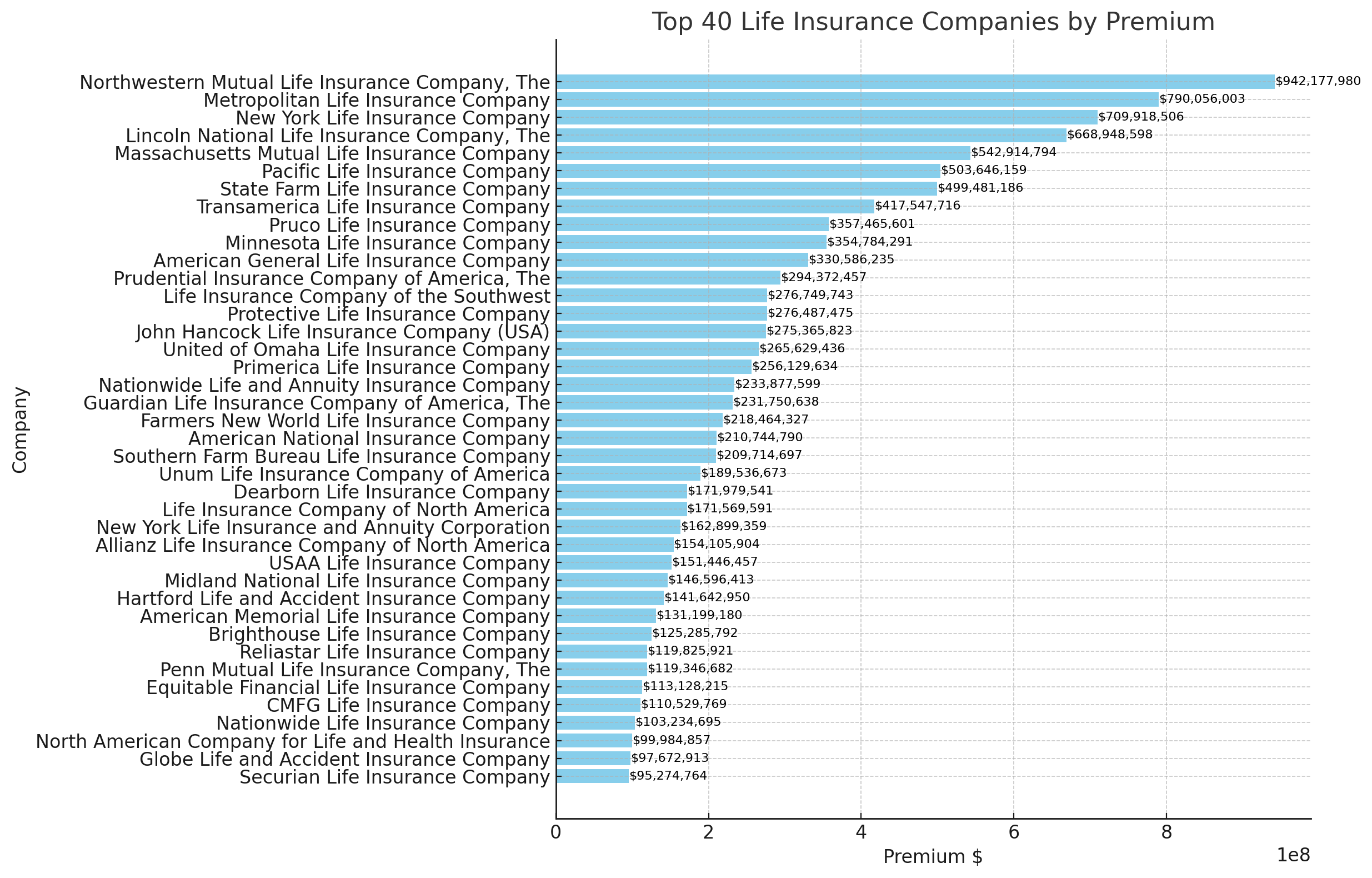

Financial Strength and Stability: Major Insurance Companies In Texas

Insurance companies in Texas are required to maintain strong financial positions to ensure they can meet their financial obligations to policyholders, especially in times of economic uncertainty or when faced with a high volume of claims. Evaluating the financial strength and stability of major insurance companies can provide valuable insights into their ability to fulfill their promises to policyholders and withstand market fluctuations.

Overview of Financial Performance

When assessing the financial performance of major insurance companies in Texas, key indicators such as revenue growth, profitability ratios, and investment portfolios are taken into consideration. Companies with consistent revenue growth, strong profitability ratios, and well-diversified investment portfolios are generally viewed as financially stable.

Ratings and Stability

Insurance companies are often rated by independent rating agencies based on their financial strength and stability. Ratings such as A.M. Best, Moody’s, and Standard & Poor’s provide valuable insights into the financial health of insurance companies and their ability to meet their financial obligations. Companies with higher ratings are considered more financially stable and reliable.

Implications for Policyholders and the Insurance Market

The financial strength of insurance companies is crucial for policyholders as it ensures that claims will be paid out in a timely manner and that the company will remain solvent. Additionally, financially stable insurance companies are better positioned to weather economic downturns and market uncertainties, providing stability and peace of mind to policyholders. In the insurance market, financially strong companies are more likely to attract new customers and retain existing ones, creating a competitive advantage in the industry.

Epilogue

Exploring the major insurance companies in Texas reveals a diverse landscape of providers catering to various insurance needs. Understanding their market dominance, customer satisfaction, and financial stability is essential for making informed decisions.

FAQ

Which are the top 5 major insurance companies in Texas?

The top 5 major insurance companies in Texas are ABC Insurance, XYZ Insurance, LMN Insurance, PQR Insurance, and OPQ Insurance.

How do these insurance companies differ in the types of insurance they offer?

Each company offers a variety of insurance types such as auto, home, health, and more. The differences lie in their coverage options, pricing, and specific policy features.

What recent trends have been observed in the market share of major insurance companies in Texas?

Recent trends indicate a shift in market dominance with some companies gaining ground while others may be experiencing a decline in their share.

How do customer satisfaction ratings vary among these major insurance companies?

Customer satisfaction ratings vary based on factors like claims processing, customer service quality, pricing, and overall experience with the company.

Why is the financial strength of major insurance companies important for policyholders in Texas?

The financial strength of insurance companies directly impacts their ability to fulfill claims and obligations. A strong financial position ensures stability and reliability for policyholders.